Medicare Supplement Insurance Medigap Limit OutOfPocket Costs

Medigap Plan G is the most popular Medicare Supplement Insurance plan available to any Medicare member. [1] Plan G covers certain expenses such as coinsurance, copayments and deductibles that aren.

Medicare Supplement FAQs

Medigap (Medicare Supplement) If you are enrolled in Medicare Part A and B (Original Medicare), Medigap plans can help fill the coverage gaps in Medicare Part A and Part B. Medigap plans are sold by private insurance companies and are designed to assist you with out-of-pocket costs (e.g., deductibles, copays and coinsurance) not covered by Parts A and B.

Medicare Supplement Plans — Even Better Insurance

The Benefits of Medigap Insurance. The advantage of a Medicare supplemental insurance plan is that you may have a more extensive network of providers to choose from. If you have a health condition.

Medicare Supplement/Medigap • New to Medicare • Idaho Department of

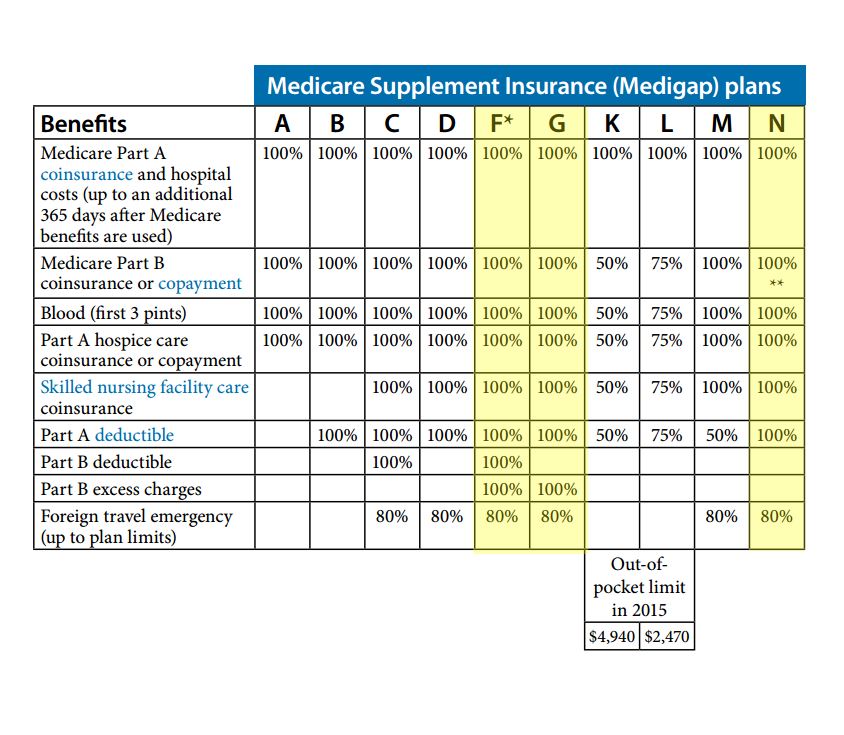

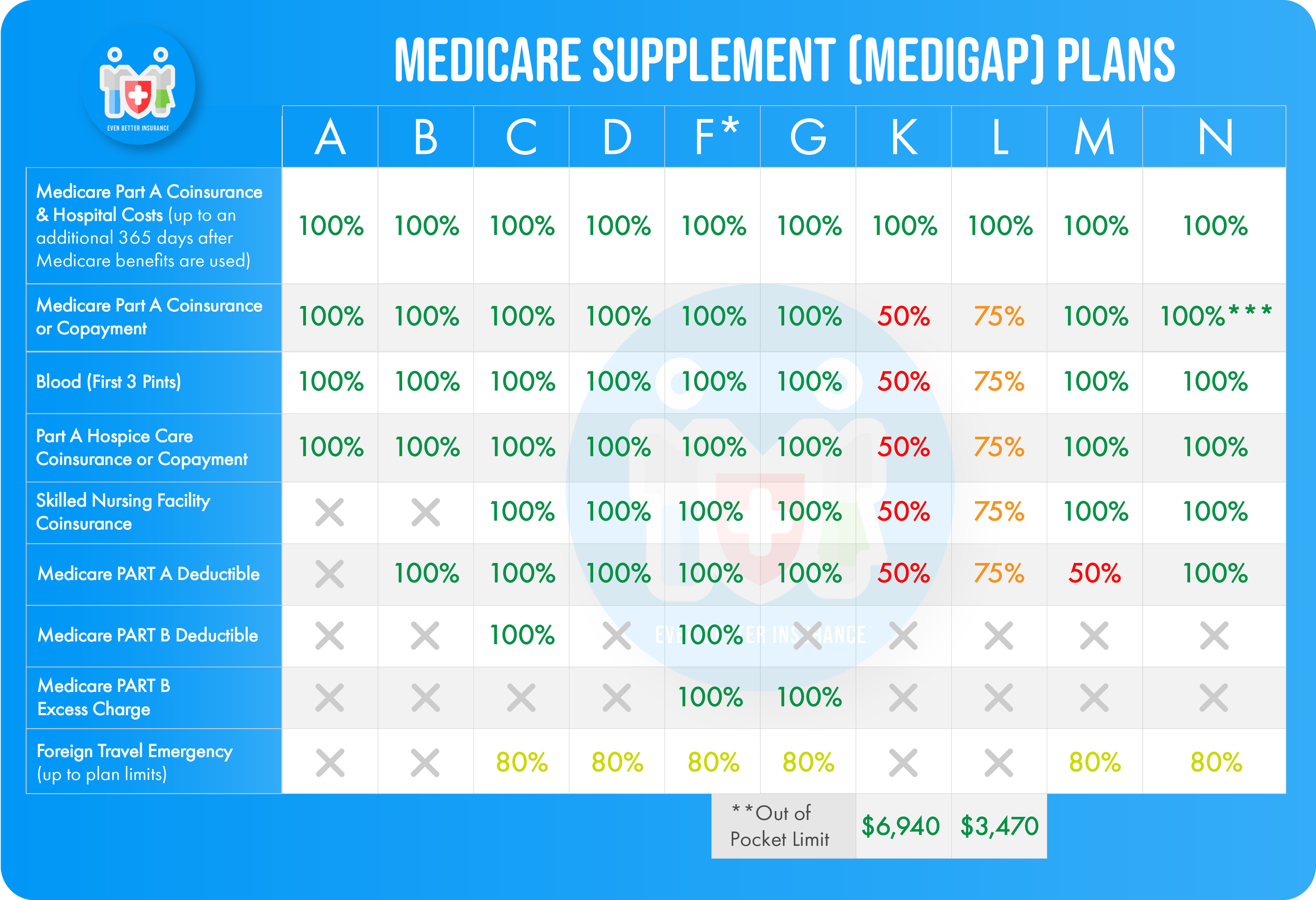

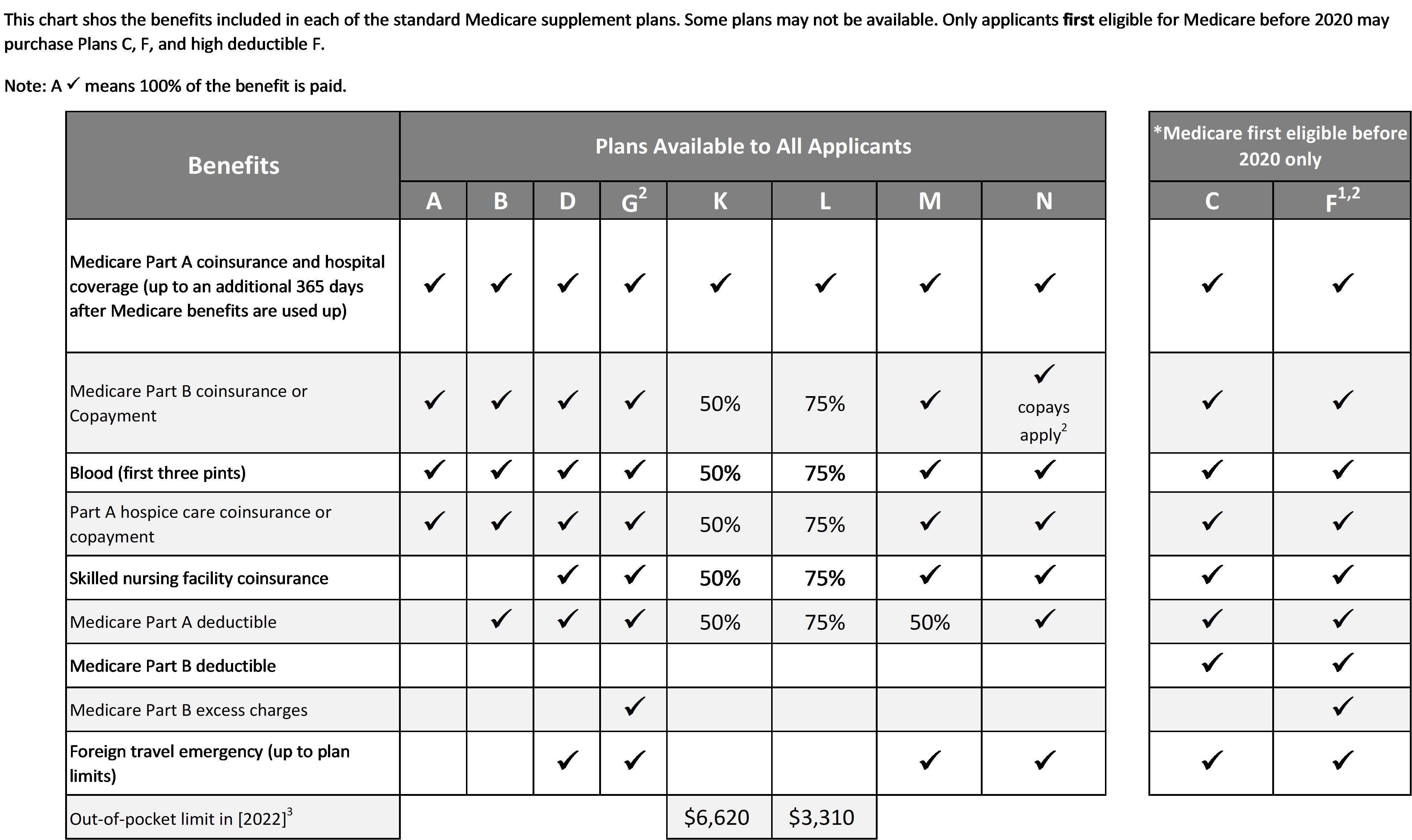

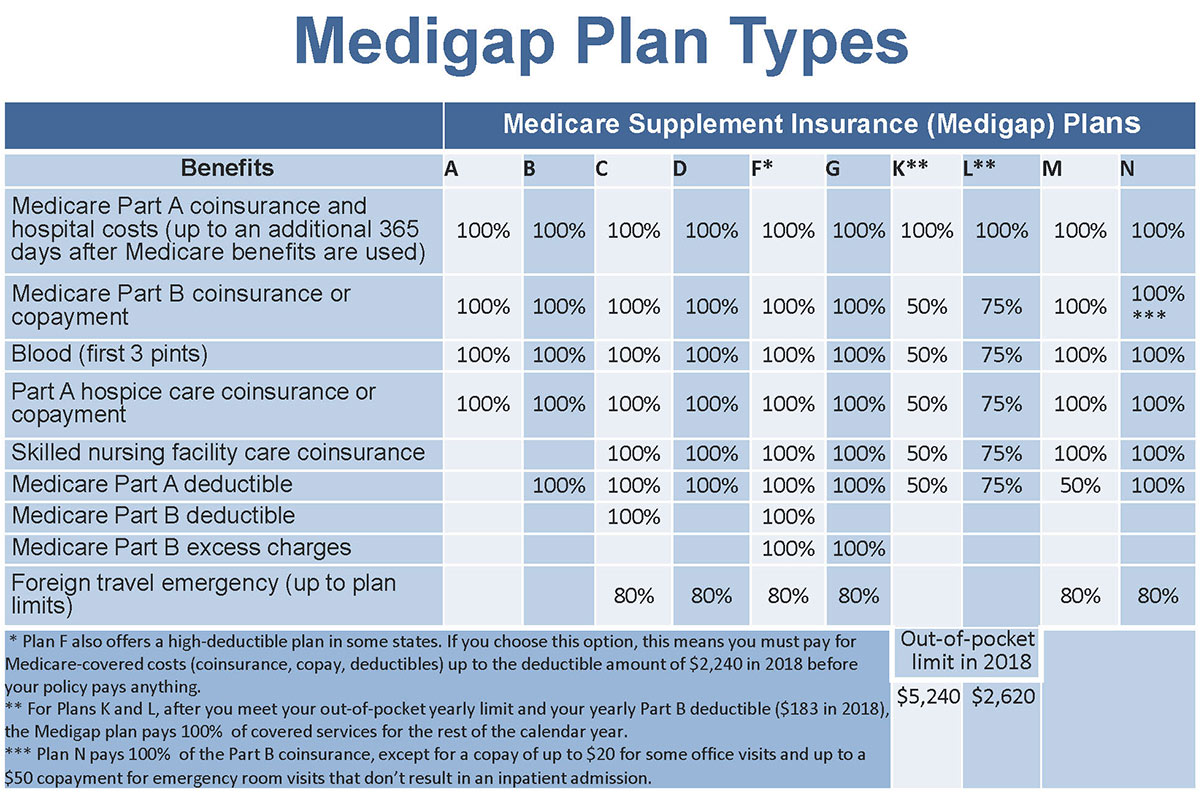

Medicare Supplement Insurance is also known as Medigap. Medigap plans are optional purchases to cover out-of-pocket costs for Medicare Part A and/or Part B. In most states, there are 10 letter.

Medicare Supplement High Deductible Plan F (HDF)

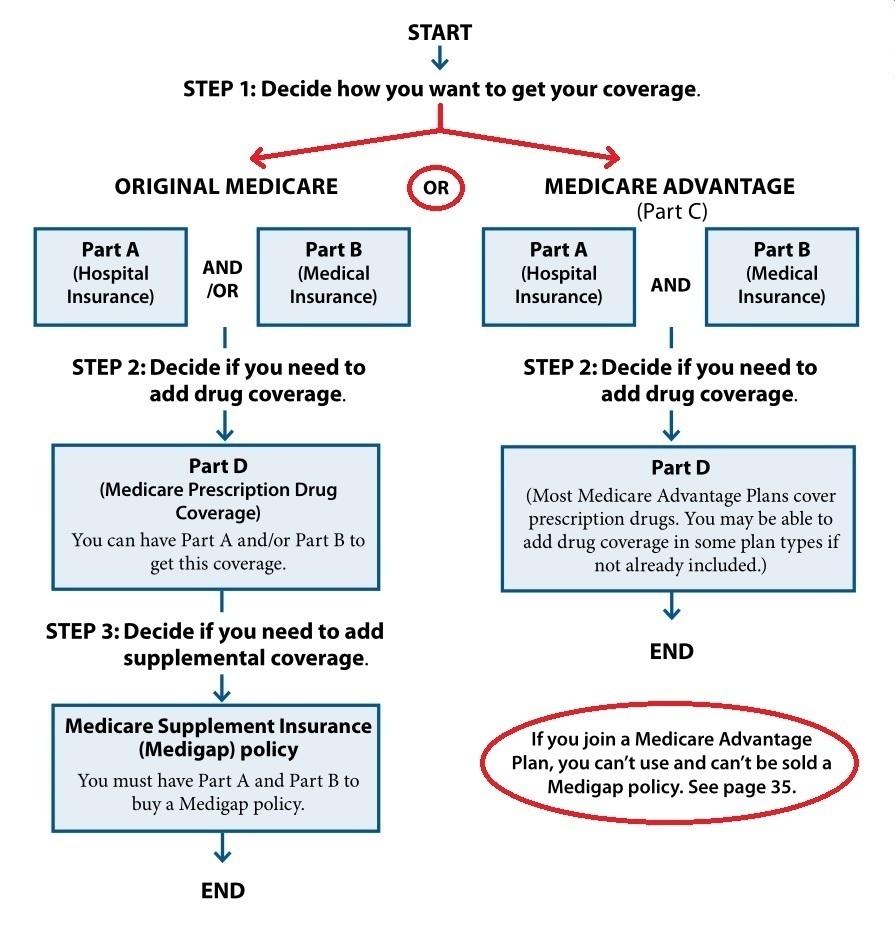

Here's what you need to know if you're in the market for a supplemental policy. 1. Medigap plans are only for original Medicare enrollees. They are sold by private insurance companies but regulated by states and the federal government. Original Medicare pays 80 percent of covered Part B health care services.

Nevada Medicare Supplement (Medigap) Plan N Nevada Medicare

Medigap, also known as Medicare supplement insurance, is an insurance policy that supplements Original Medicare. It's designed to cover some or all of the out-of-pocket costs that a beneficiary would otherwise have to pay for services covered by Original Medicare. Original Medicare does not have a cap on out-of-pocket costs, and most people.

Medicare Supplement Plan A for 2023

Best for premium discounts: Mutual of Omaha Medicare Supplement Insurance. Best for extra benefits: Anthem Medicare Supplement Insurance. Best for nationwide availability: Blue Cross Blue Shield.

What Is The Different Between Medigap Plans And Medicare Advantage Plans

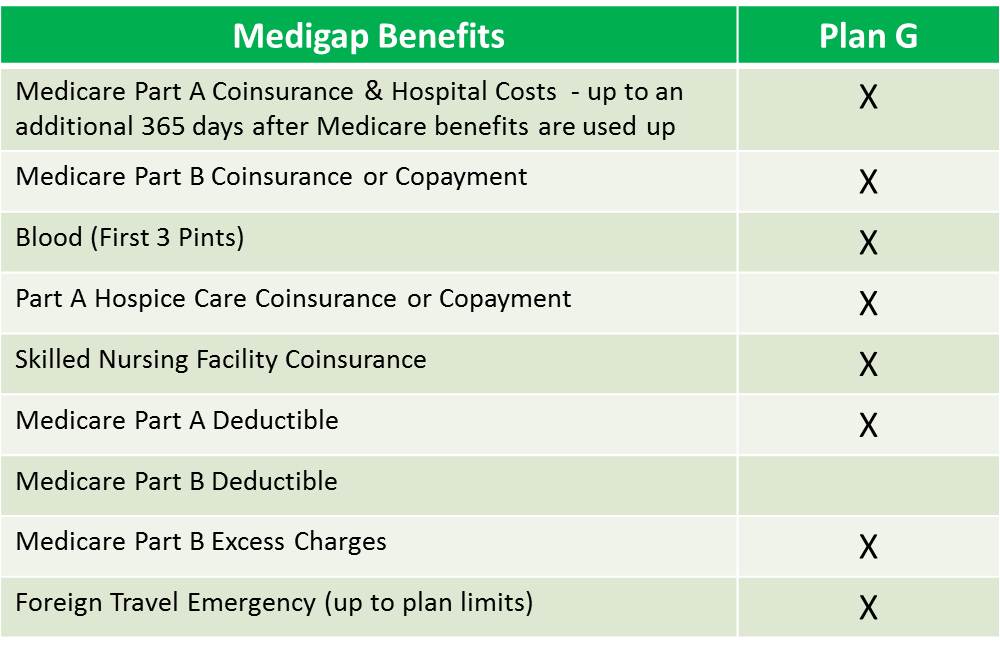

10 Standardized Medicare Supplement (Medigap) plans chart This chart shows the benefits included in each of the standard Medigap plans effective on or after Jan. 1, 2024. The Medigap policy covers coinsurance only after you've paid the Medicare deductible (unless the policy you have also covers the deductible)..

Medicare Supplement (Medigap) Plan G Benefits and Coverage

Like other Medicare supplement plans, you buy a Plan N Medigap plan from a private insurer. Plan N was the third most popular Medicare supplement choice for Medicare recipients behind Plan G and.

Medigap Plan G Medicare Supplement Plan G

Medigap is Medicare supplemental insurance sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance. In some cases, Medigap will also cover.

What Is Medicare Supplement (Medigap)? Coverage, Costs, Eligibility

What's Medigap (Important to Know) 4 secrets to affordable Medigap Plans

Medigap can be purchased during the six-month period that starts the month you're 65 or older and obtain Medicare Part B. During this time, called the Medigap open enrollment period, companies.

Choosing the Best Medicare Plan for You at Age 65

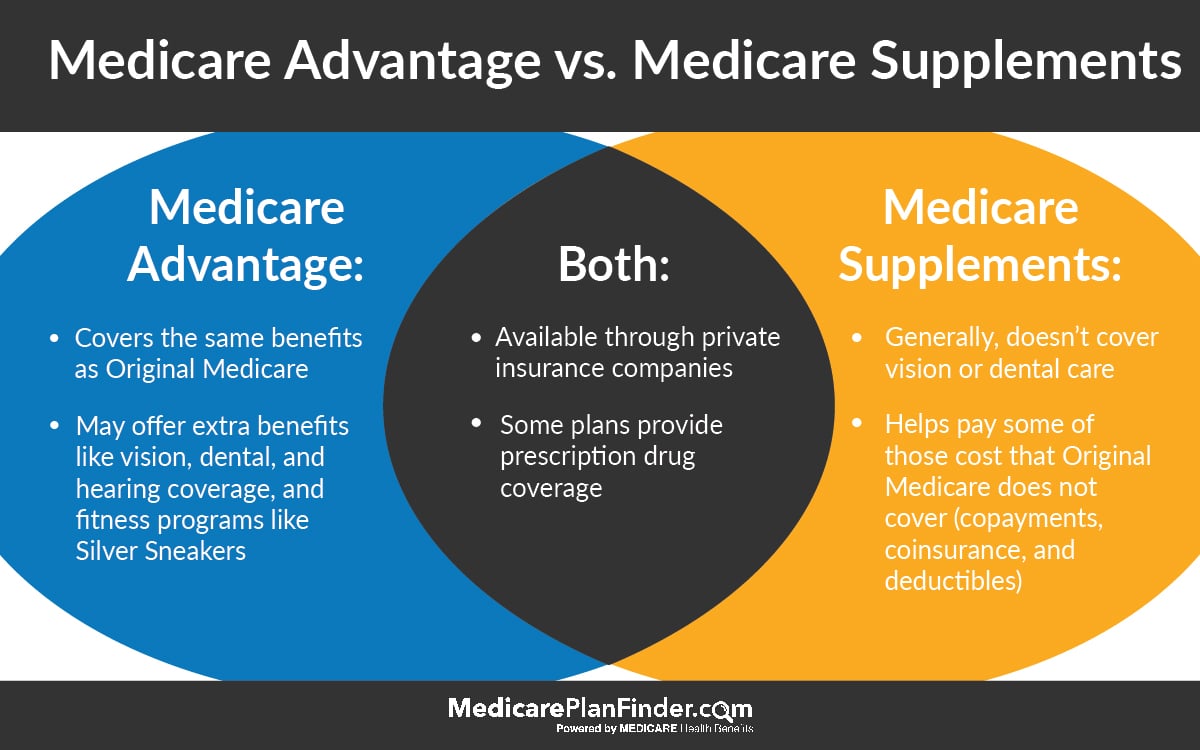

Medigap and Medicare Advantage are both coverage options for people with Medicare, but Medigap policies supplement original Medicare, while Medicare Advantage is a private insurance alternative to federally run Medicare. They're very different, and their unique types of coverage can't be combined. Only those enrolled in original Medicare.

Medicare Supplement Plan F in 2023

Just three Medicare Supplement Insurance plans cover more than 80% of all Medigap beneficiaries. Here are the most popular plan types as of the end of 2021. Plan F covers 41% of members. Plan G.

Top 5 Medicare Supplement Plans for 2024

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out-of-pocket costs in. Original Medicare. . Generally, you must have Original Medicare -. Part A (Hospital Insurance) and. Part B (Medical Insurance)

What is Medicare Supplement (Medigap) Insurance? IHS Insurance Group, LLC

For more information on Medigap policies, you may call 1-800-633-4227 and ask for a free copy of the publication "Choosing a Medigap Policy: A Guide to Health Insurance for People With Medicare." You may also call your State Health Insurance Assistance Program (SHIP) and your State Insurance Department.